- Fair Tax

View Poll Results: FOR or AGAINST the Fair Tax

- Voters

- 102. You may not vote on this poll

-

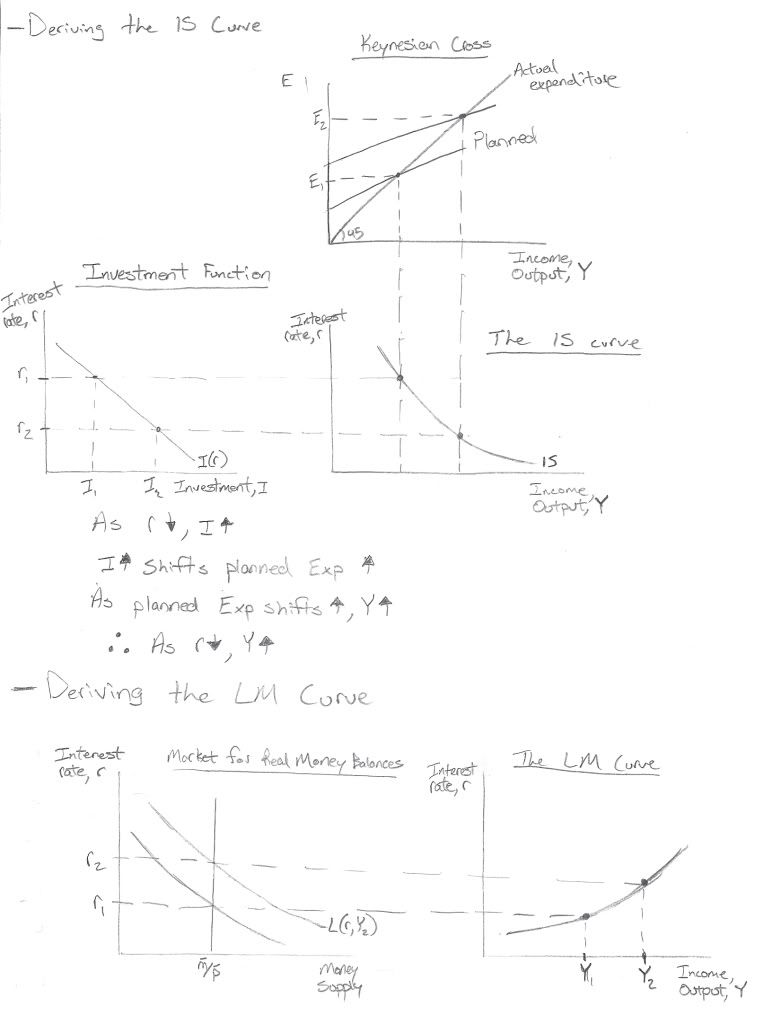

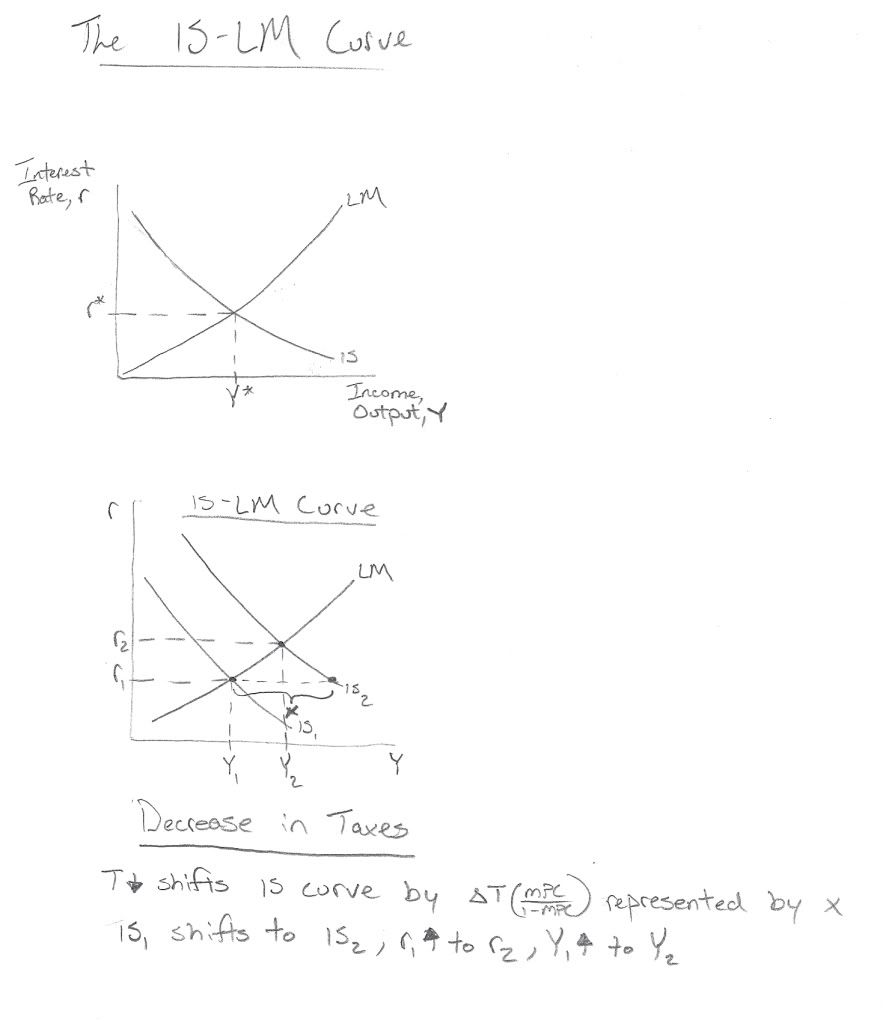

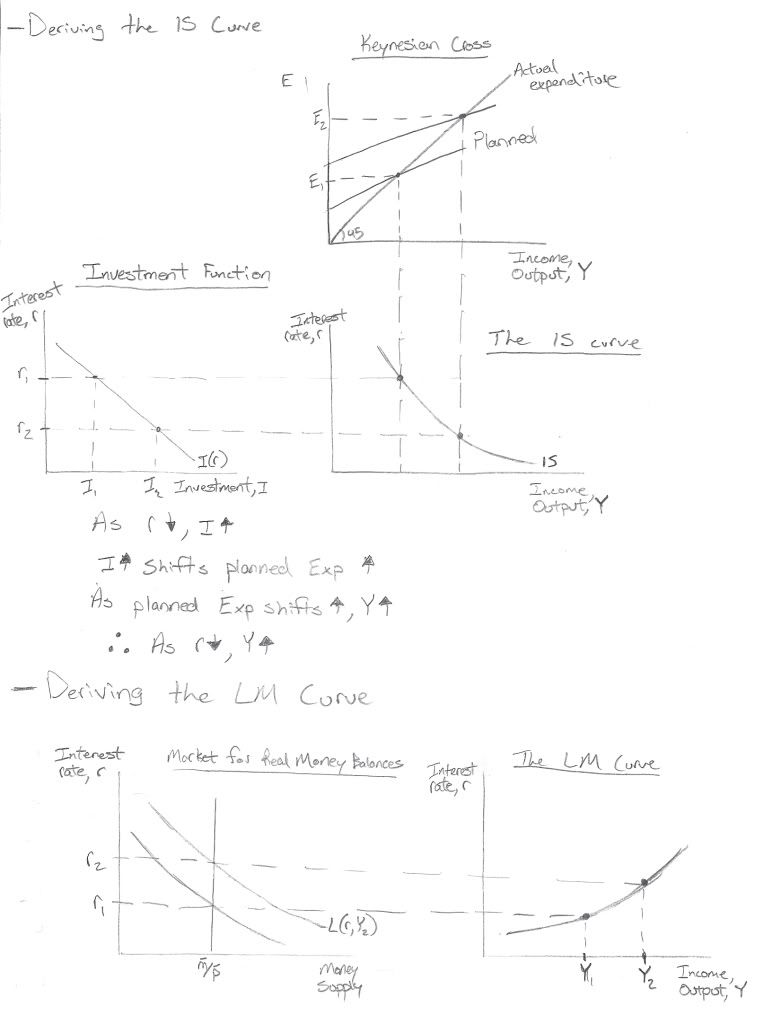

These first two are simply showing how we come up with the IS-LM curve. The increase and decreases are simply for reference (not fair tax example)

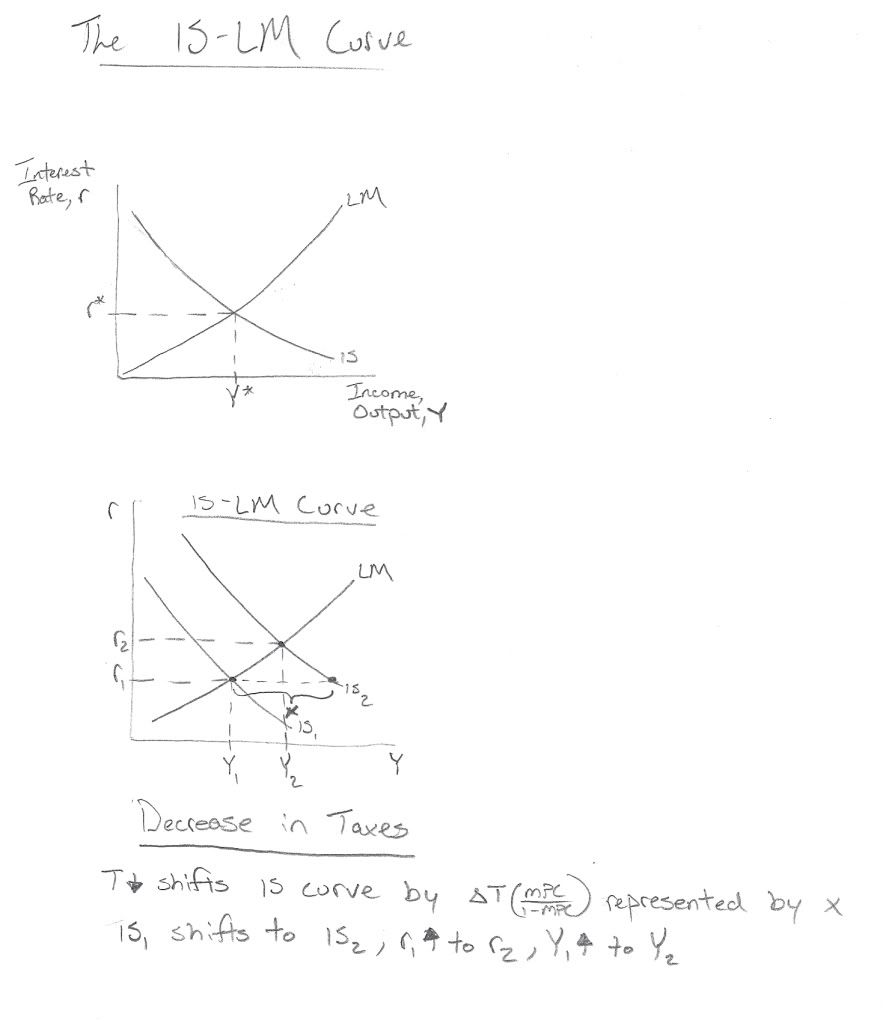

So at the bottom (after deriving the curve) we know that Fair Tax (as stated above by the solow growth model) would actually decrease tax revenue at the 23% level of sales tax and no income tax. Granted I left out cost cutting on the government because thats a whole nother issue (even if we eliminated the IRS... it only costs about $10 billion per year in cost to the US government). So we know the LM curve is only effected by Monetary policy changes and the IS curve will shift for fiscal policy changes. Yes I know I am making the assumption that taxes are taxes but it affects the IS curve regardless (IS curve represents the goods market equilibrium). So with a decrease of taxes (-5 as we spoke about earlier) the IS curve will shift out by ΔT(MPC/[1-MPC]). This new IS-LM equilibrium increases Income as well as raises interest rates.

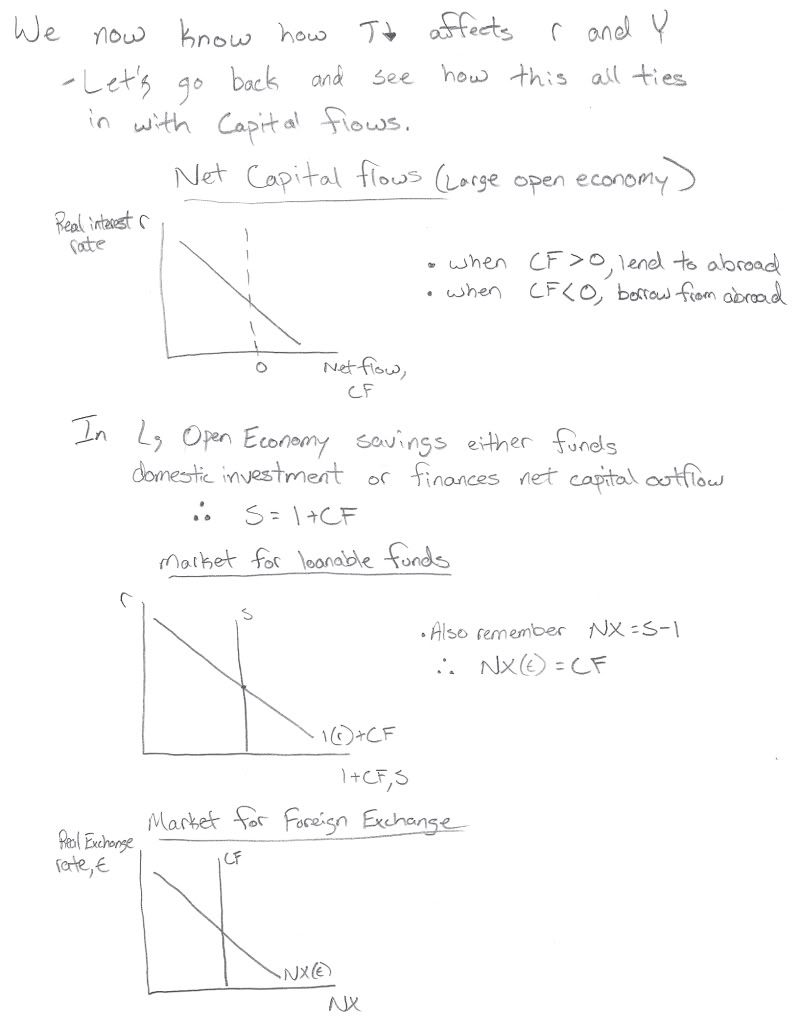

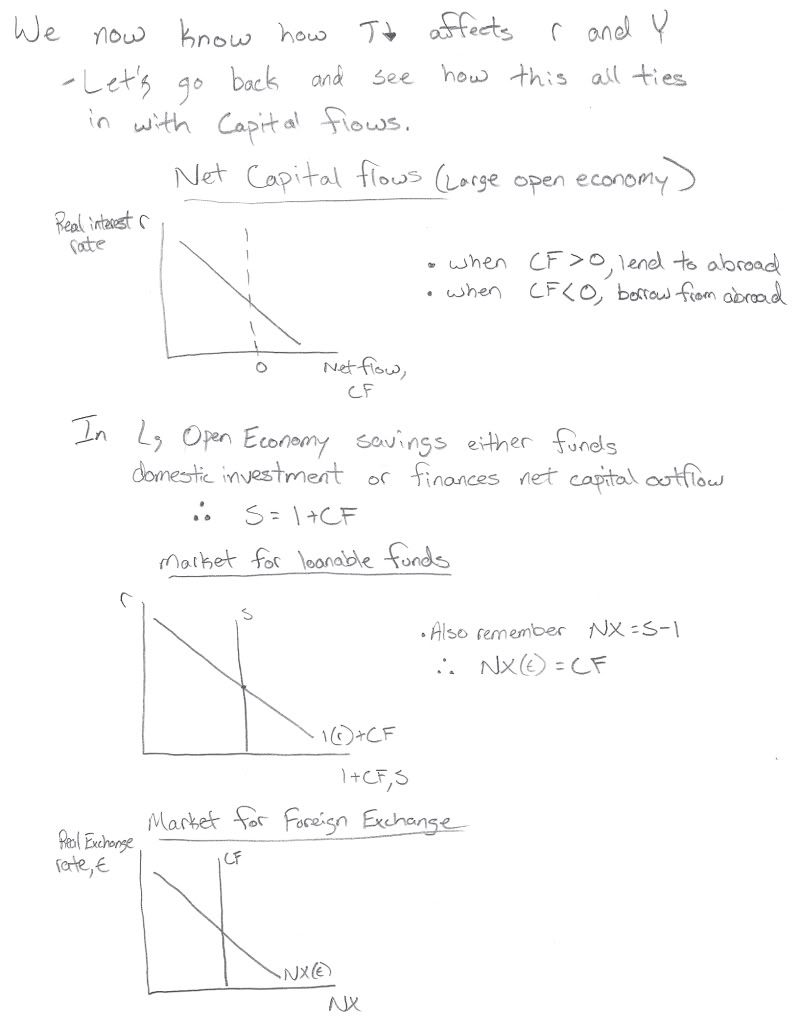

So now we know what will happen with r and Y. We can move on to the more relevant markets of CF and NX. When Net CF is positive it means that we are investing abroad. When it is negative, it means they are investing in domestic firms. Simple, higher domestic interest rates will cause domestic firms to borrow from abroad (for investment) due to lower interest rates over there. Likewise, the lower our interest rates, the more attractive it is for us to lend to foreign economies. However this explanation can change depending on real exchange rates and domestic investment (higher r does not always mean capital flows going abroad... only if you hold CF constant... but we can't because increased income levels will affect available capital)

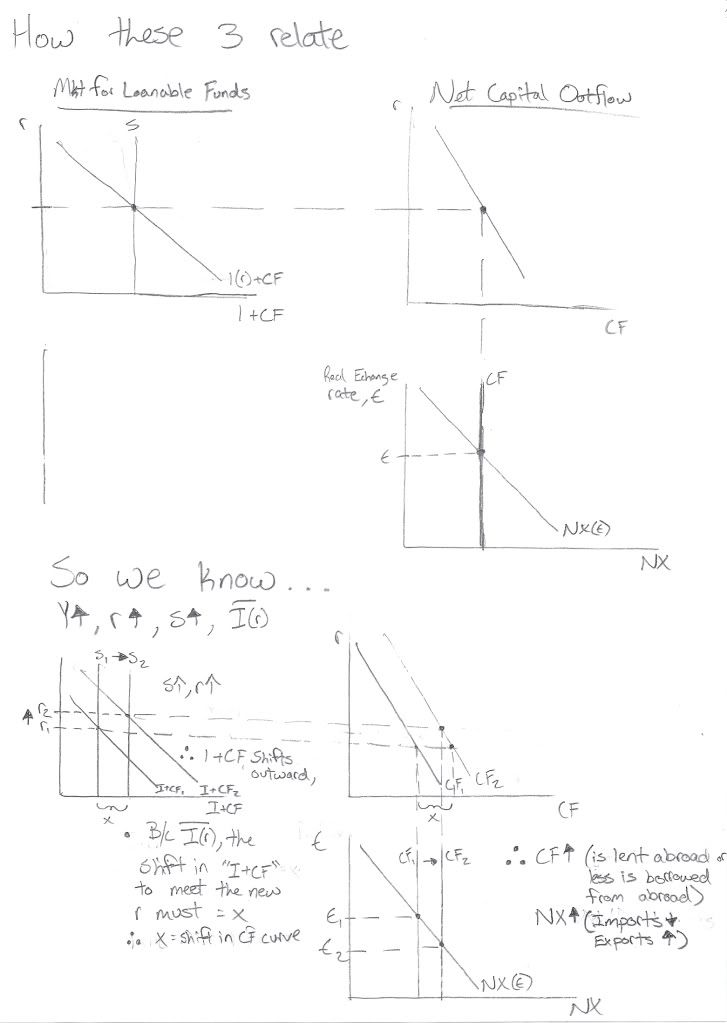

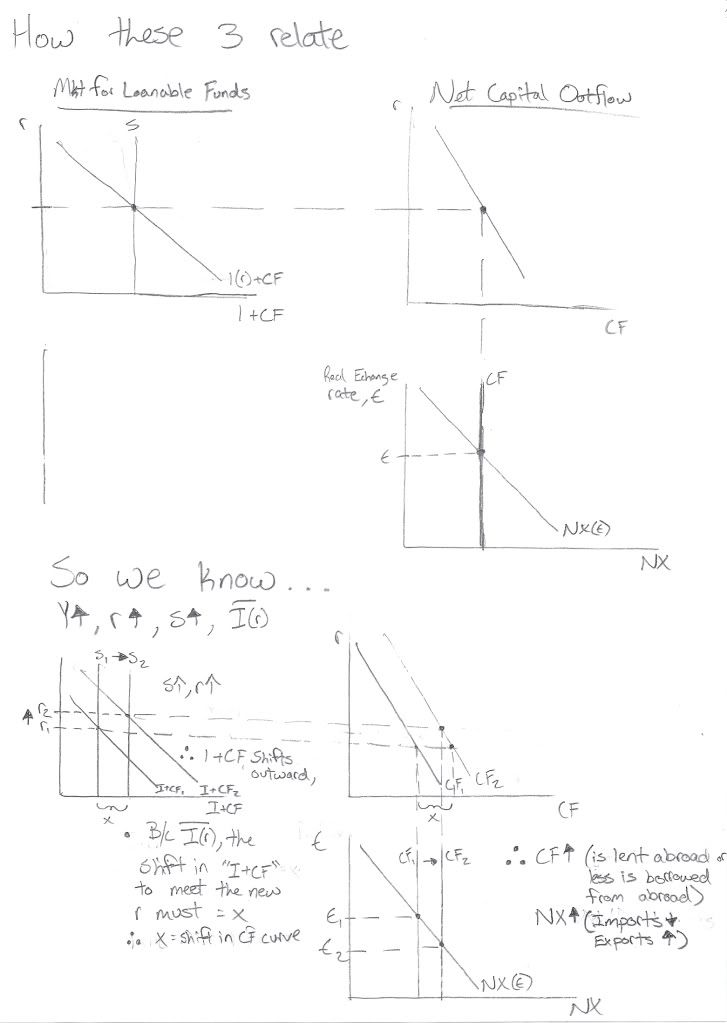

Now all 3 of these correlate. Finally we apply in the very bottom what we already know from above. Y will increase, r will increase and savings will increase. We start with the Loanable funds market. Generally speaking, because of crowding out effect of a larger government deficit we will see less than a 3.75% increase in S but S will increase none the less. S increases along with an increase in R, the only way for a new equilibrium to be met is a shift in capital flows due to more overall capital available in the economy (increase in income). We hold I(r) constant because the only thing that will change demand in investment will be government tax stimulus or technological innovation. We see the shift in CF from CF1 to CF2 and the new equilibrium says that more capital is being lent abroad (the balance has shifted towards more capital of outflow than previous equilibrium). We also relate this directly to the market for foreign exchange and see that the outflow of capital translates into a lower real exchange rate and an increase (more positive) trade balance (Exports-Imports is becoming less negative or more positive).

In the end through all this we have established Fair Tax will increase our overall GDP and stimulate significant growth, all the mean while lowering tax revenue. This poses the same problem we are facing now with an ever increasing national debt. Granted it wouldn't be a trillion dollar increase to the deficit but it would be simliar to what was estimated above (20% decrease in tax revenue. annual average tax revenue now ~= 2 trillion dollars) so we'd see an increase of ~400 billion in our national defecit. IMO this is a trade off. I believe the increases in GDP would be more valuable to our economy than restraining from the debt, not to mention establishing a solid growth rate will ALLOW us to pay off our national debt in the future.... leaving things as they are now, our national debt is going to run this country's economy down the shitter before we leave the workforce.... Our country will have to resort to one (or all) of the three, increased taxes or printing money or cutting costs......... none of which has outcomes the public likes. My suggestion, create a system that feasibly eats down our deficit and prevent it from becoming an enormously large unpayable burden on our children.

Last edited by Verik; 09-16-2009 at 12:34 AM.

- Fair Tax

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote